VodafoneThree has switched on its Multi-Operator Core Network (MOCN) across 600 mast sites in the UK, a key milestone in the ongoing merger of Vodafone UK and Three UK. The upgrade allows 27 million customers on Vodafone UK, Three UK, VOXI, Talkmobile, and Smarty to connect to whichever mast delivers the strongest 4G or 5G signal, at no extra cost.

The operator aims to expand MOCN to 9,000 sites by March 2026, with a full nationwide rollout planned over the next eight years. Early deployment is focused on locations where one network’s coverage is weaker, improving speeds and reliability in both rural communities and high-demand urban areas.

Current Rollout Progress

The MOCN programme began in mid-2025 with limited trials. In June, just 24 mast sites were live, all in areas chosen to bridge clear coverage gaps between Vodafone and Three.

Only two months later, the pace had picked up considerably. By August, 600 masts were operational under the shared system. VodafoneThree says this acceleration will continue, with the aim of reaching 9,000 sites by March 2026. That milestone will deliver access to the company’s fastest 5G services to roughly 71% of the UK population.

The order of deployment is deliberate. Early upgrades are focused on semi-rural areas and the outer edges of cities, where one network often had significantly stronger coverage than the other. The same applies to urban spots with high congestion, where additional mast options can dramatically improve performance.

How MOCN Works in Practice

Multi-Operator Core Network technology allows two mobile operators to share their Radio Access Network (the masts and antennas) while keeping their own core networks separate.

In VodafoneThree’s case, this means both companies’ 4G and 5G Non-Standalone (NSA) services run on a common layer of access equipment, but each still has its own systems for handling customer authentication, account features, billing, and service rules.

When a device searches for a signal, it scans for both Vodafone and Three cells. Whichever mast offers the strongest, least congested signal is chosen. The shared radio layer connects the user to the network, while the data and control traffic are routed back to their original operator’s core systems. This keeps all the usual features – such as data allowances, parental controls, and voicemail – exactly the same.

The benefits are immediate in areas where only one operator had strong coverage. It also improves capacity, as customers can be moved away from a busy mast to another site nearby that has spare bandwidth. By pooling spectrum and sharing access, the combined network can handle more traffic without slowing down at peak times.

At the moment, MOCN is in place for 4G and 5G NSA. Standalone 5G (SA) – which uses a fully separate core – is still run on each operator’s original infrastructure. SA roaming between networks is planned for a later stage once the unified core is ready.

Operators in the Rollout

The MOCN rollout covers all VodafoneThree’s main consumer and business brands:

- Vodafone UK – postpaid and business contracts with higher-capacity data plans.

- Three UK – postpaid consumer and business contracts, plus competitive unlimited data offers.

- VOXI – flexible no-contract SIMs with unlimited social media data.

- Talkmobile – affordable monthly SIM plans.

- Smarty – low-cost, flexible SIM-only options.

All customers on these networks are automatically included, with no opt-in process. For now, mobile virtual network operators (MVNOs) using Vodafone or Three’s infrastructure are not covered.

Projected Rollout Map – What Changes Where and When

From its starting point of 24 live sites in June 2025, the programme has grown to 600 sites in August. By March 2026, the target is 9,000 active masts. This will eliminate 4G coverage gaps across an extra 16,500 km² of the UK – an area around ten times the size of Greater London.

Phase 1 (2025–2026): Targeted upgrades in areas where one operator had strong coverage and the other had poor or no coverage. Includes semi-rural commuter belts, market towns, and the suburban edges of large cities.

Phase 2 (2026–2030): Concentration on busy transport routes, urban areas with high network usage, and large venues. Sites will also be prepared for 5G SA with upgraded backhaul connections.

Phase 3 (2030–2034): Nationwide 5G SA availability, migration to a single core network, and fixed wireless access expansion to cover 82% of UK households. Final infill work will close the last remaining gaps.

What’s Improved So Far

VodafoneThree says around seven million Three UK customers are already seeing the benefits, with average 4G download speeds up by about 20% in upgraded areas. Some places have recorded gains of up to 40%.

These improvements come from having more masts available in each location, giving the network more flexibility to balance loads and avoid congestion. It also means fewer drop-outs in areas where one network’s footprint used to be patchy.

The same principle applies to Vodafone customers, who now have access to previously unavailable Three sites. This is especially noticeable in rural or fringe areas where one provider had gaps in its coverage.

Better Coverage and Speeds

The shared network setup addresses two major challenges at once:

- Capacity: In busy locations such as city centres or stadium areas, customers can be shifted from crowded masts to others with free capacity.

- Coverage: Areas that were previously only served by one of the networks can now be covered by both, reducing dead zones.

By March 2026, VodafoneThree expects its fastest 5G NSA services to be available to about 71% of the UK population. The coverage boost is supported by the expansion of 4G into an additional 16,500 km².

Things Still to Come

Although MOCN already works for 4G and 5G NSA, Standalone 5G remains separate for each network. This means SA benefits such as ultra-low latency and advanced enterprise features are still tied to the customer’s original operator footprint.

The long-term targets are ambitious:

- 99.95% population coverage for 5G SA by 2034.

- Fixed wireless access to reach 82% of households by 2030.

UK Mobile Scene

The wider UK mobile sector is also moving forward on 5G. EE has launched 5G SA in selected locations and plans to reach more than half the population by the end of August 2025, with further expansion in 2026. Virgin Media O2 has switched on 5G SA for business customers nationwide and is expanding availability to more towns and cities through 2025.

Government policy is pushing operators to improve rural coverage under the Shared Rural Network (SRN) programme, which aims for 95% UK landmass 4G coverage by the end of 2025. Projects like VodafoneThree’s MOCN help meet these goals more quickly by avoiding duplicated mast builds and making better use of existing infrastructure.

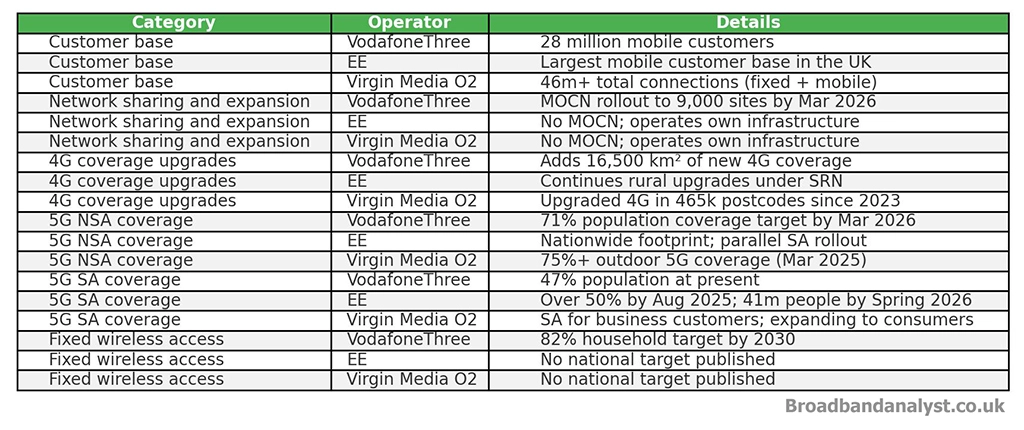

UK Operators Compared

Customer base

- VodafoneThree: 28 million mobile customers.

- EE: largest mobile customer base in the UK.

- Virgin Media O2: over 46 million total connections across fixed and mobile.

Network sharing and expansion:

- VodafoneThree: MOCN rollout to 9,000 sites by March 2026.

- EE: no MOCN; operates its own infrastructure.

- Virgin Media O2: no MOCN; operates its own infrastructure.

4G coverage upgrades:

- VodafoneThree: adds 16,500 km² of new 4G coverage.

- EE: continues rural upgrades under SRN.

- Virgin Media O2: upgraded 4G in 465,000 postcodes since 2023.

5G NSA coverage:

- VodafoneThree: 71% population coverage target by March 2026.

- EE: nationwide footprint, parallel SA rollout.

- Virgin Media O2: over 75% outdoor 5G coverage as of March 2025.

5G SA coverage:

- VodafoneThree: 47% population at present.

- EE: over 50% by end of August 2025, 41 million people by spring 2026.

- Virgin Media O2: SA for business customers, expanding to consumers.

Fixed wireless access:

- VodafoneThree: 82% household target by 2030.

- EE: no national target published.

- Virgin Media O2: no national target published.

What VodafoneThree and Analysts Say

Andrea Donà, VodafoneThree’s Chief Network Officer, describes MOCN as a “milestone in delivering improved connectivity” – pointing to faster speeds, stronger coverage, and better network resilience.

Industry analysts agree that MOCN offers major benefits for rural coverage and congestion management. However, they also warn that integrating two national networks is a complex process, requiring careful planning to maintain service quality during the transition.

Summing It Up

With 600 sites live and thousands more on the way, VodafoneThree’s MOCN rollout is one of the most significant network projects currently underway in the UK. It is already boosting speeds and coverage for millions of users, with more benefits to come as the build progresses.

Full Standalone 5G and a unified core network are still a few years away, but the early results show why this shared network model could set the standard for future mobile rollouts. If VodafoneThree maintains its pace, it could become the UK leader for combined 4G and 5G coverage over the next decade.