The UK was among the early adopters of 5G technology, promising revolutionary changes to mobile broadband connectivity. However, recent industry data reveals that despite initial enthusiasm, the UK lags significantly behind other European countries in terms of real-world 5G availability, standalone (SA) network deployments, and overall user experience. What’s holding the UK back, and how can providers overcome these challenges?

5G Availability in the UK

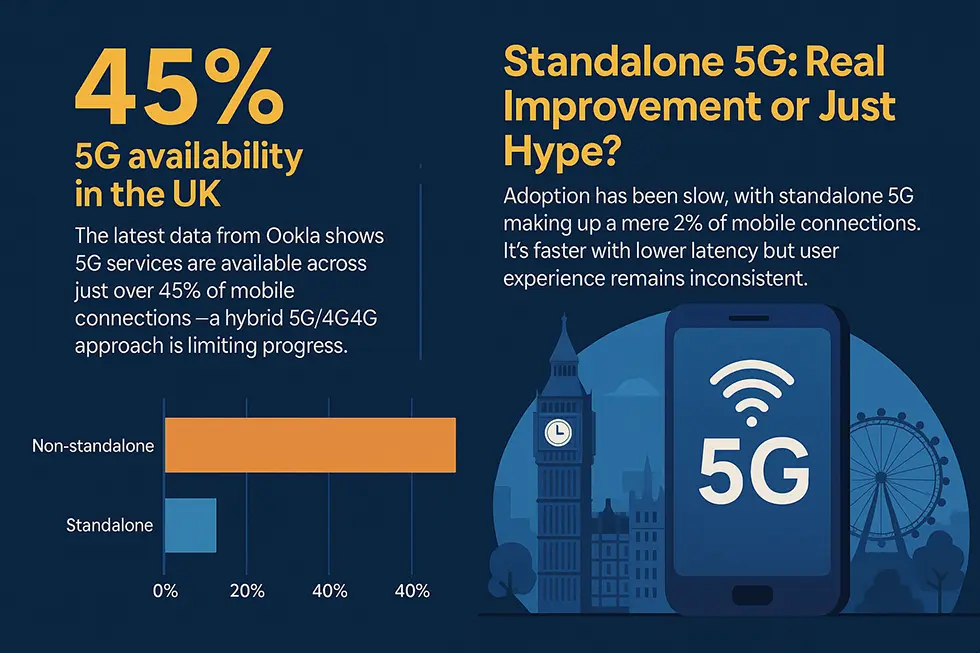

The latest data from Ookla places the UK in a disappointing position, with just over 45% of mobile connections having access to 5G services. This is surprisingly low, given the UK’s early push into 5G deployments and extensive marketing by operators. Comparatively, Denmark has achieved almost double the UK’s availability, with over 83% of connections already benefiting from 5G networks.

Part of the issue is infrastructure investment. Most 5G connections in the UK remain on non-standalone (NSA) networks—these networks rely heavily on older 4G architecture to provide connectivity. This hybrid model limits the full advantages that pure 5G standalone (SA) infrastructure would bring, such as ultra-low latency, stable high-speed connections, and efficient network slicing capability.

Standalone 5G: Real Improvement or Just Hype?

Although the standalone version of 5G networks promises significant performance improvements—including noticeably faster download speeds, lower latency, better support for Internet of Things (IoT), and enhanced energy efficiency—adoption has been slow. Currently, standalone 5G comprises a mere 2% of all UK mobile network connections.

Ofcom’s recent Mobile Matters report confirms that standalone 5G provides download speeds approximately 45% faster on average compared to the non-standalone networks. This is crucial for high-bandwidth activities such as cloud gaming, ultra-high-definition streaming, and seamless remote working. Latency—the measure of responsiveness in a network—also sees substantial improvements in SA networks, being around 15% lower than on NSA systems.

However, despite these clear benefits, user experience with SA is still mixed. Ofcom noted a slightly lower connection success rate with SA compared to NSA (96% vs. 98%). Although not dramatically different, it’s clear that providers must optimise stability and reliability before standalone becomes mainstream.

Rural Users Still Left Behind on 5G and 4G

A significant challenge that remains unresolved is the performance disparity between urban and rural areas. Urban areas experience higher rates of 5G adoption, nearing 30%, compared to under 20% in rural regions. This translates into faster average download and upload speeds in cities and large towns. Rural users frequently report connections struggling to maintain even basic stability, let alone high-speed consistency.

Northern Ireland and Wales in particular face noticeable performance gaps, both on 4G and 5G networks. Lower proportions of high-speed connections, along with noticeably longer file download times, underline a need for targeted infrastructure investment. Addressing these rural connectivity issues must become a central strategy if providers and regulators are serious about digital inclusion.

Mobile Operator Performance: Winners and Losers

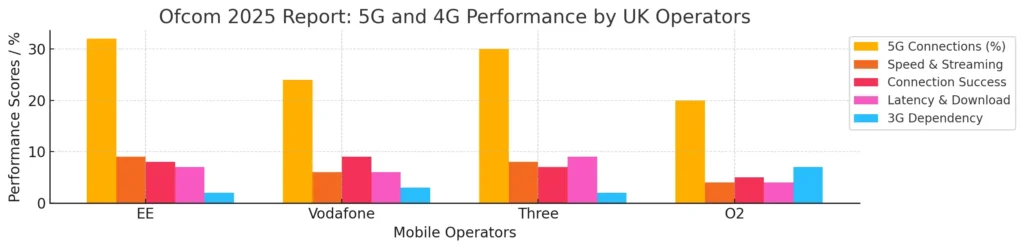

Ofcom’s report highlighted clear variations in how different operators perform across 5G and 4G services:

- EE leads the pack in terms of proportionate 5G connections at nearly 32%. They also maintain strong overall speed and reliable video streaming performance.

- Vodafone struggles to migrate users onto 5G, still retaining a large base on 4G. They did, however, perform well in connection success rates.

- Three stood out for impressive 5G latency performance and download speeds, especially notable in delivering reliable video streaming and rapid file downloads.

- O2 lags behind, still relying more heavily on its fading 3G network, with slower response times and limited coverage transition towards 5G.

This suggests that providers with aggressive 5G investment strategies and simplified customer migration plans are winning the battle for consumer trust.

What Spectrum Reform Means for 5G and Fixed Wireless internet

Ofcom recently approved reforms to the UK’s 3.9GHz spectrum, largely used by Three UK’s fixed wireless access services. These changes, including adjusting frequency assignments to a lower band (3800–3884MHz), will streamline spectrum usage and enhance network efficiency.

The primary benefit is clearer, less fragmented spectrum allocation, enabling improved quality and faster connections for both residential and enterprise broadband. Three UK, through its home broadband service, will now be better placed to deliver robust, high-speed broadband, particularly valuable in areas where fibre deployment is slow or challenging.

Ofcom’s reforms also mean private and community broadband projects have better opportunities to access shared spectrum, supporting innovation and improving localised connectivity. However, existing Shared Access licensees will have to adjust their equipment within 18 months unless they agree on interference mitigation with Three UK directly.

Next Steps for Expanding 5G Across the UK

The UK’s mobile broadband strategy must evolve rapidly to bridge gaps and realise the full benefits of 5G. Potential solutions include:

- Increasing standalone network investment: Providers must transition faster from NSA to SA networks. Incentivising this shift through regulatory or financial support could accelerate adoption.

- Enhancing rural coverage: Providers and regulators need targeted policies and clear incentives for improving rural infrastructure. Public-private partnerships and subsidies can ensure rural communities enjoy equitable connectivity.

- Transparency in pricing and performance claims: Broadband providers must avoid exaggerated marketing claims. Clearer communication around realistic 5G availability and expected speeds will foster trust and consumer satisfaction.

- Robust spectrum management: Continued optimisation and reassignment of spectrum will ensure efficient use, minimising interference and maximising bandwidth available for commercial and residential users.

Closing Note

The UK’s journey with 5G illustrates the challenges of rapidly rolling out advanced broadband technologies. While urban users begin to enjoy improved speeds and lower latency, rural communities still wait for meaningful connectivity upgrades. The shift to standalone 5G networks, though promising, remains slow and uneven.

Providers like EE and Three demonstrate clear strategies and capabilities to deliver robust 5G performance. Meanwhile, Vodafone and O2 have catching up to do—particularly in network migration and quality of service. Ofcom’s spectrum reforms, meanwhile, create an important foundation for wireless broadband growth, potentially closing coverage gaps quicker than wired solutions alone.

Ultimately, the UK can still lead in mobile broadband—provided regulators and operators collaborate effectively, addressing inequalities in connectivity, driving forward standalone 5G networks, and managing the spectrum responsibly. The rewards for doing so will be transformative—delivering on the genuine promise of fast, reliable mobile broadband nationwide.